Finally, an easy-to-use, affordable, top-notch 1099 Software! Choose from two versions, depending: E-File or Print compatible with Windows® and Mac® operating systems.

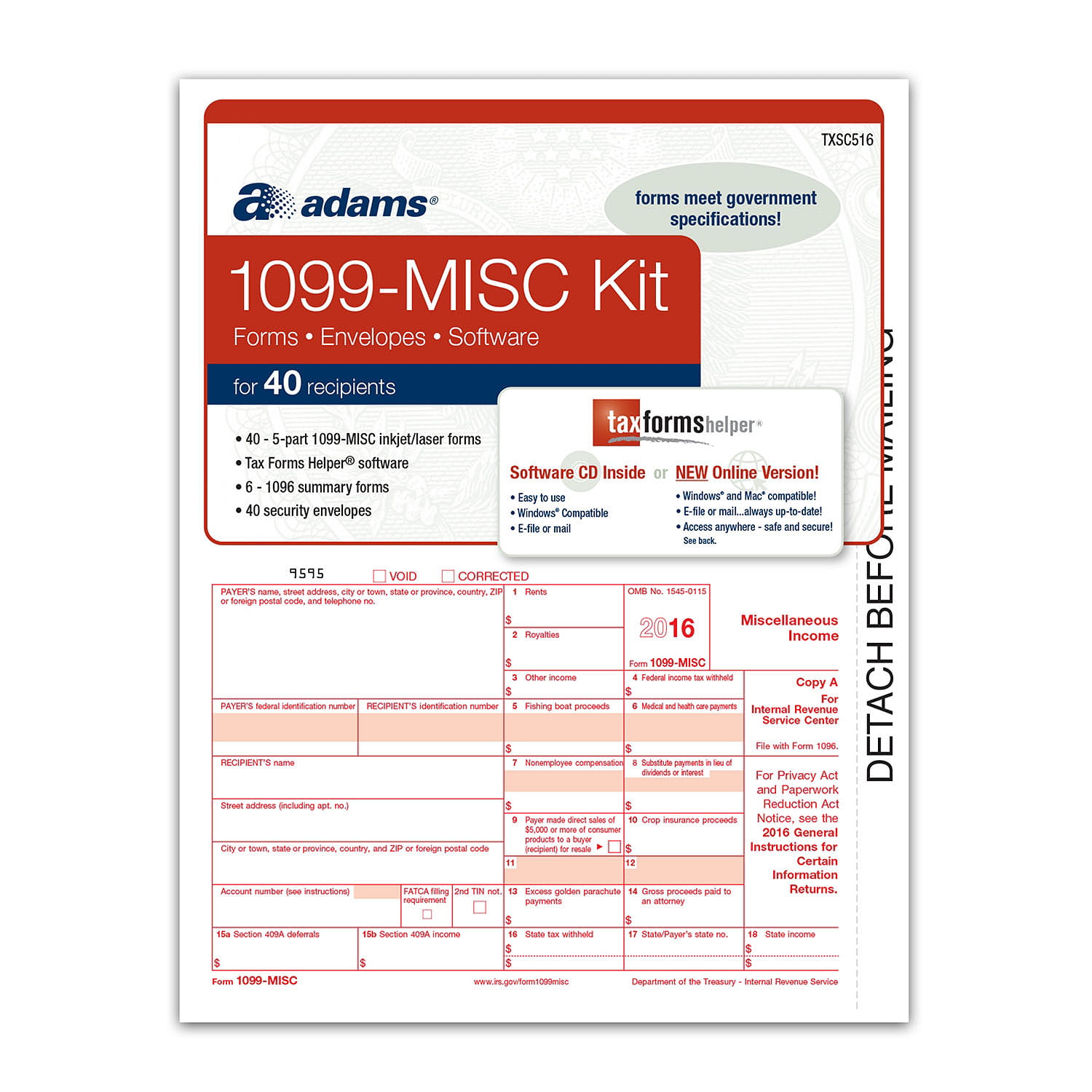

The 1099-MISC Tax forms can help you complete the paperwork required for filing taxes. The forms include all the required entries for non-employee payments so you can record and submit information for independent contractors. Each form features the current tax year prominently displayed at. 1099 misc Forms 2019, 4 Part Laser Tax Forms Kit for 25 Vendors and Self-Seal Envelopes, Pack of Federal/State Copy's, 1096's –Great for QuickBooks and Accounting Software, 2019 1099 MISC 4.3 out of. How To Download 1099 Misc Tax Forms Software Kit? 1099 Misc Tax Forms Software For Mac. Software For 1099 Misc Forms. 1099 Misc Forms With Software. 1099 Misc Laser Tax Forms And Software Set. 1099 Misc Forms 2017 With Software. 1099 Misc Tax Form Software. Form 1099 Misc Software.

CheckMark 1099 program includes 1099-MISC, 1099-INT, 1099-DIV, 1099-R and 1099-S forms. When filing forms 1099-MISC & 1099-INT, you may print recipient copies on blank paper. The copies you file with the IRS and state must be on pre-printed forms. Macos forensic data recovery software crashed hard drive. For forms; 1099-R, 1099-S & 1099-DIV, print all forms on pre-printed forms. Save time by importing prior year data. Choose the E-file version to file electronically via the IRS’s FIRE system (requires prior registration with the IRS).

Enter your information in screens designed to look like the real forms 1099 and eliminate mistakes. Our program is specifically designed to handle unlimited companies and unlimited recipients. Lorex cclient 13 app for mac.

1099 Misc Software Online

Before you can E-File, you must submit Form 4419 (Application for Filing Information Returns Electronically) and receive approval from the IRS. For more information visit www.irs.gov/pub/irs-pdf/f4419.pdf

Tax Software For 1099 Misc

*Please note: The IRS may take up to 45 days to approve your application and you need to create an account on the IRS’s FIRE system in order to submit your filings.