- Apr 05, 2019 In desperation, I held on the phone for 1 hour and almost 50 minutes for H&R Block software support. They immediately knew what was causing the issue and told me how to correct it. (It’s a darn shame they don’t just post it on their website, which I also searched.).

- The software would not allow me to make a correction which it said was needed for my return. I contacted HRB support. Almost 3 hours on the phone. Not resolved. One support person was fantastic, but because this is tax software he was not allowed to help beyond basic software issues. The 'Tax Preparer'was worthless. Never gave me an answer.

Click on a link to view frequently asked questions about:

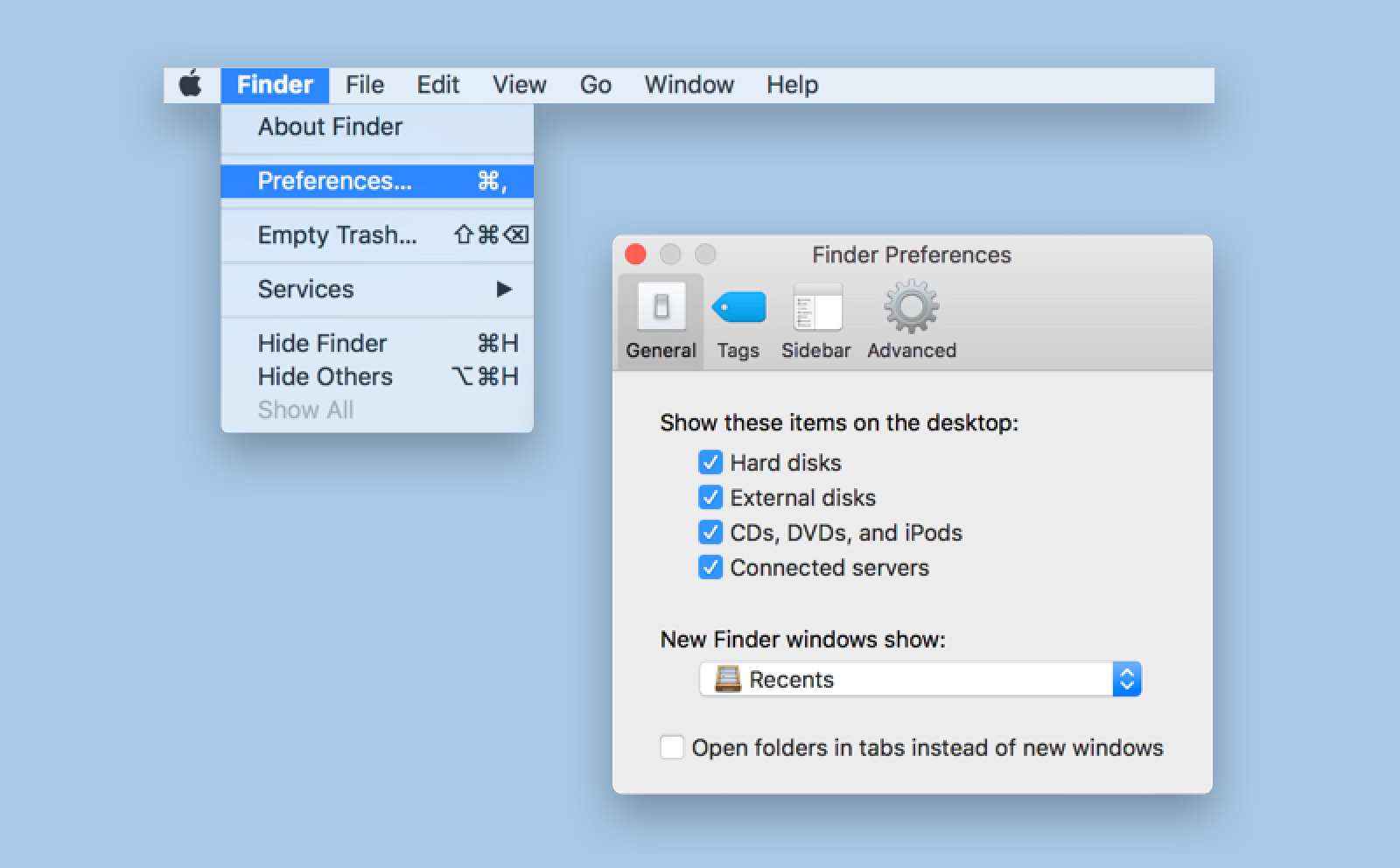

Close the H&R Block Tax Software program. Right-click the.exe file and choose Run as Administrator. If you can’t find the update file you downloaded, you might have to perform a search for the file. Follow the instructions displayed by the update program to complete the installation. Update H&R Block Software for Mac users. You can visit our website to see any updates available to you for this year or any prior-year software. For a federal update: Under the Federal Updates section, click.

If you can't find an answer to your question here, check out the Troubleshooting sections in Help.

About importing

How do I review the entries I imported from my last year's return?

If you want to review entries you imported from last year's return, we recommend you review them using the Review Last Year's Data report. To display the report, go to the Reports menu and choose Review Last Year's Data.

About the Interview

How do I move forward when I don't see a Next button?

Some screens include more in-depth assistance or ask more questions about a particular topic. You’ll find a scroll bar on the right side of these screens that you can use to scroll down through all the content on that topic. When you reach the end of the screen, you’ll see the Next and Back buttons.

How do I go back to a section where I forgot to include some information?

If you miss a step, you can easily go back to that section using Take Me To. It is located on the toolbar at the top of the main window.

Click Take Me To.

Scroll through the list of topics to find the topic that you missed. Classroom management app for mac.

Choose the topic name to highlight it.

Click Go To.

Why doesn't the program accept the date I enter for date of birth, date of purchase, and/or sales date?

You need to enter dates in the format of MM/DD/YYYY. Ex: 07/24/1957

If you enter only two numbers for the year, the software won't accept it.

About forms

How do I get rid of a form I don't need or want?

Forms are included in your return based on the data you've entered. Before deleting a form, verify that you've entered all the information correctly in your return. Once you've determined that you don't need the form:

Go to the Forms menu and choose Open Forms.

Choose the Federal tab or State tab (Ex: New York) to display the list of available forms. A state tab displays only if you've started a state return.

Double-click the form that you want to open.

In the Copy Number list box, choose the copy number of the form that you want to delete.

Click Delete Form.

Click Yes to confirm the deletion.

About returns

Why doesn't the software point to the folder that contains my last year's return file when I try to import last year's information?

If your 2015 return isn't listed, find the folder where you saved it. If you accepted the program's default folder recommendations, you can find your return in the following directory:

Documents/HRBlock/

Your return file will be saved with a .T15 extension. (Ex: If you saved your 2015 return as MyTaxes, look for a file named MyTaxes.T15.)

If you don't remember where you saved your 2015 return, you can locate it using Windows search.

To search using Windows 7, Windows 8, and Windows 10, click the Start button, and then type *.T15 in the search box.

Search results appear as soon as you start typing in the search box. The search results are based on text in the file name, text in the file, and other file properties.

To search using Windows XP:

On the Task bar, click Start and choose Search.

Choose For Files or Folders.

In the What do you want to search for? list, choose All files and folders.

Enter *.T15 in the All or part of the file name: text box.

Click the drop down arrow next to Look in:, and choose where you want to search. Use Browse to search in sub-folders. (The C: drive is the most commonly used location for saving files.)

Click Search.

The search results will display the name and location of any 2015 returns found in the specified location.

Why aren't areas of text showing up on forms being printed on an Epson printer?

If you're printing H&R Block returns using an Epson printer manufactured between May 2004 and May 2006, a setting in the printer's preferences is causing a printing problem. Choosing the RAW data type setting on your printer's printing preferences should fix the problem.

To choose this setting:

Click Start, choose Settings, and then click Printer, and Faxes.

Right-click on your printer icon, then choose Printing Preferences.

Choose the Utility tab.

Click Speed & Progress.

Click the check box next to Always spool RAW data type.

Click OK.

How do I get out of the current return and create a blank one so I can start over?

You can create as many returns as you need. All you have to do is remember the file name of the returns you want to work with.

To create a new blank return:

Go to the File menu and choose Create New Return.

We'll ask if you want to save the changes to the current file before you open a new file.

Click Yes to save the changes, or No to discard them. Click Cancel to return to the current file without creating a new file.

On the My Taxes screen, click Start a Return.

About filing

When is the e-filing season?

You can e-file your return with our software usually from early January -- when the IRS opens for the tax season -- through Oct. 16. The IRS begins processing returns on its opening day.

How many returns can I e-file?

You can e-file up to five federal returns. You can file an unlimited number of paper returns.

How many state returns can I e-file with my federal return?

/TurboTAx-Free-Edition-57aa8a3c5f9b58974a32775e.png)

You're allowed to e-file up to three state returns with each federal return you file.

You can e-file part-year resident and nonresident returns for these states:

Arizona

California

Connecticut

Georgia

Illinois

Kansas

Maryland

Massachusetts

Minnesota

Missouri, New Jersey

New York

North Carolina

Pennsylvania

Ohio

Oregon

Virginia

Here, you can follow these steps to repair your external hard drive on Mac. Step 1: Open Disk Utility application. Step 2: Select the external hard drive and erase it with Disk Utility. Disk Utility will format and erase the external hard drive under Mac OS. Then your external hard drive is able to be reused, recycled, or resold. It is very simple.

Mac Free External Hard Drive Recovery is the leading Mac Data Recovery software specially designed for external hard drive to recover files lost due to deletion, format, raw, virus attack, system.

Mac Free External Hard Drive Recovery is the leading Mac Data Recovery software specially designed for external hard drive to recover files lost due to deletion, format, raw, virus attack, system.

You can e-file only part-year resident returns for Washington D.C.

Can I use a credit / debit card to pay my taxes?

You can use a Visa, Mastercard, American Express, or Discover card to pay your federal taxes. The payment processors the IRS uses for credit card payments will charge a convenience fee to your credit card. There's a fixed fee for Visa Debit and ATM Debit.

On the credit card payment web site, you'll enter your:

Federal tax payment

Social Security number (SSN)

Additional identifying information

Your convenience fee amount is calculated for the payment at this time.

Once the payment has been processed, you'll be provided with a confirmation code. Your credit / debit card statement will show a payment to U.S. TREASURY TAX PAYMENT as further proof of payment. The convenience fee will be included on the statement as a PAY USA TAX CONVENIENCE FEE.

Here's some additional information to keep in mind:

If you made your payment after April 18, you might be subject to late payment interest and penalties.

Here are some common reasons that a credit / debit card transaction might be declined:

Your credit / debit card account doesn't contain a sufficient line of credit to complete the transaction.

You haven't provided the correct names or account information.

If you make an error, the transaction can't be reversed. You must request a refund through the existing tax refund procedures. Once you've authorized a credit / debit card payment, the Treasury can't cancel any requested payment made by credit / debit card.

If the service provider fails to forward the tax payment to the Treasury, you're responsible for the tax payment and for any penalties and interest.

What is H&R Block's Privacy Policy?

You can view H&R Block's Privacy Policy at https://www.hrblock.com/privacy.

What should I do if I've already e-filed my return and I just noticed it contains an error?

The IRS has already started processing your return and your refund, if you're expecting one. Complete Form 1040X: Amended Individual Income Tax Return. See Opening a Form.

What should I do now that it's almost April 18 and the IRS has rejected my e-filed return and is requiring me to submit my return on standard paper forms?

If you're afraid you won't meet the April 18 deadline, write the following by hand on the top of your paper Form 1040:

TIMELY FILED REJECTED ELECTRONIC RETURN

This should ensure you won't be hit with a late filing penalty.

About updates

Are there other ways to get an update other than downloading from within the software?

If you're having a problem downloading an update from within our program, you can download the update from our Update Center.

If you're running Microsoft Windows Vista ™, Windows 7, Windows 8, or Windows 10 operating system, you'll need administrator privileges to download and install updates.

About state programs

How do I get my state program?

If you're running Microsoft Windows Vista ™, Windows 7, Windows 8, or Windows 10 operating system, you'll need administrator privileges to download and install state programs.

If you bought an H&R Block Tax Software edition that includes a state program:

Open the program.

Click the State tab.

Choose your state from the drop-down list.

Click Next. The software checks to see if your state program is available. If it's available, it's automatically downloaded and installed for you.

If your state program isn't available, we’ll show you the date that the program should be available. If you'd like us to email you when the program becomes available, enter your email address.

Can't Update Hr Block Tax Software On Mac Free

If you need to buy your state program:

Open the program.

Click the State tab.

Choose your state from the drop-down list.

Click Next. The software checks to see if your state program is available. If it's available, the Enter State Purchase Information screen displays.

If your state program isn't available, we’ll show you the date that the program should be available. If you'd like us to email you when the program becomes available, enter your email address.

Enter your billing information and your email address. You need to enter your email to complete the purchase.

Click Next.

Review the information listed on the Purchase State screen to make sure it's correct.

Click Purchase. We'll email you additional order and installation information once you click this button.

How do I reinstall my state program?

If you're running Microsoft Windows Vista ™, Windows 7, Windows 8, or Windows 10 operating system, you'll need administrator privileges to download and install state programs.

To reinstall a Windows H&R Block Tax Software state program:

Open the program.

Go to the Tools menu and choose Re-install State Program.

Choose the state program you want to install.

Follow the instructions displayed.

If you've deleted the HRBlock2016 program directory, you can't re-install your state program.

To reinstall a Mac H&R Block Tax Software state program downloaded from within the federal program:

Find the following folder: ~/Library/Application Support/H&RBlock/2016/Completed Updates where ~ indicates your home folder.

Double-click the .dmg file for the state that you want to reinstall.

Double-click the XX.TCstate16 file, where xx is the two-letter abbreviation for your state. Ex: NY.TCstate16

If you've deleted the ~/Library/Application Support/H&RBlock/2016/Completed Updates folder, you can't reinstall your state program.

To reinstall a Mac H&R Block Tax Software state program downloaded from our online store:

Find the folder where you stored the downloaded file (*.dmg).

Double-click the .dmg file for the state you want to reinstall.

Double-click the XX.TCstate16 file, where xx is the two-letter abbreviation for your state. Ex: NY.TCstate16

If you downloaded a state program from our online store, the .dmg file isn't placed in the ~/Library/Application Support/H&RBlock/2016/Completed Updates folder.

Let’s see the handpicked top pro and free tax software for Mac, Nowadays if you do not have the personal accountant then also you can easily get alerts regarding when to pay tax return and how much you can save on that. Some of the experts have made such a beautiful platform which can give you complete guidance regarding taxes and its laws.

Besides this, you can also estimate how much you can save on the return that you are going to file right on the software. Small firms, large firms or even if you are self-employed it will help you to carry over your problem.

we are happy to help you, submit this Form, if your solution is not covered in this article.

Compatible with macOS Catalina, macOS Mojave, High Sierra, macOS Sierra, EI Capitan, Mac OS Yosemite

Top Best Tax Software for All Macs [MacBook Pro, MBA, iMac, MacMini]

1: TaxSlayer

TaxSlayer is pretty simple to use. Depending on your requirement you can select any model such as classic, premium or self-employed. And if you want for paying simple tax such as state tax or federal tax or 1040EZ form, then it is available for free. Simple tax includes form filling of 1040EZ, a self-employed category is for freelancer or contractors or 1099s, and a premium version is for VIP support. If you want quick and responsive and cheap software for your Mac, then TaxSlayer is the best one we’ve got for you.

2: Turbotax

Turbotax is the best tool for saving money overtax. Intuit is building such software for Mac user a while ago, and so many customers have trust in Intuit. Just like other, you can file a simple return for free and for professional use you can buy any package as per your need. Deluxe is available for $59.99, Premier is for $79.99 and self-employed for $119.99are packages available and they will charge when you file tax.

3: TaxAct

TaxAct is probably the best alternative available for above mention software. TaxAct is entirely running on the online platform, you won’t find any application in the Mac app store like others. But still, it is cheaper compared to other software and easy to use. There are five versions are available for this software Free, Plus, Basic, Self-employed and Premium. Besides this, the Premium version includes additional Audit defense. With this software will get deduct maximize which is necessary for every self-employed person, you can personalize your financial assessment and easily import and record capital gains.

4: H&R Block

H&R Block is popular on iOS, and now it is attracting peoples by its mac version. Every single facility you will get from this software, and also it provides face-to-face customer support without taking a single buck. The basic version provides all IRS forms, and it is available at cheap cost. It takes responsibility and gives the refund if you fall in trouble caused by its software. And if you are confused regarding which version is better for you, they will guide you on this. Just visit the site, and you will get everything you need.

5: Credit Karma

Credit Karma is the leading software in this category. A lot of features are available which is meant for customer benefits and welfare. Once get started with credit karma, and you will save much more. When you file tax on this software, it will double verify and check the errors, and then only it will approve it. They also track credits, refunds, and deduction and tell you what is left to do. Even you can import previously filed a return from H&R Block TaxAct or TurboTax.

Premium Support is Free Now

We are happy to help you! Follow the next Step if Your Solution is not in this article, Submit this form without Sign Up, We will revert back to you via Personal Mail. In Form, Please Use the Description field to Mention our reference Webpage URL which you visited and Describe your problem in detail if possible. We covered your iPhone 11 Pro, iPhone 11 Pro Max, iPhone 11, iPhone 8(Plus), iPhone 7(Plus), iPhone 6S(Plus), iPhone 6(Plus), iPhone SE, SE 2(2020), iPhone 5S, iPhone 5, iPad All Generation, iPad Pro All Models, MacOS Catalina or Earlier MacOS for iMac, Mac Mini, MacBook Pro, WatchOS 6 & Earlier on Apple Watch 5/4/3/2/1, Apple TV. You can also mention iOS/iPadOS/MacOS. To be Continued..

Hope you guys enjoyed and helpful in pay tax in last days with the help of Best tax software for Mac.