Your deductions for your rental activities are only as good as the records you keep to back them up. Any deduction you forget to claim on your tax return, or lose after an IRS audit because you lack adequate records, costs you dearly. Every $100 in unclaimed deductions costs the average midlevel-income landlord (in a 25% tax bracket) $25 in additional federal income taxes.

What Records Do Landlords Need?

If, like most small landlords, you haven't formed a separate business entity to own your property and have no employees, you need just two types of records for tax purposes:

Oct 18, 2019 6 user-friendly accounting software options for Mac. Rather than giving you a generic list of accounting software that works on Macs (which would basically just be our accounting software directory), I decided to determine which top factors users have for choosing Mac over PC and then find accounting software that best suits those users. Oct 09, 2017 If you’ve finally had it with the Mac version of Quicken, we’ve taken a closer look at the best Quicken alternatives for Mac of 2020. Quicken for Mac has lagged behind the Windows version for years and even though Quicken 2019 For Mac was an improvement, the decision to make Quicken subscription only was the final straw for many faithful users. The good news is that nowadays there’s. Nov 22, 2018 If you’re asking for a pre-set template for rental property accounting, I’d suggest reaching out to your local accountant. Your local accounting professional can provide advice tailored to your situation since laws and regulations relating to property management may vary based on the state, industry or specific facts and circumstances involved. With the help of Capterra, learn about Landlord Studio, its features, pricing information, popular comparisons to other Rental Property Management products and more. Still not sure about Landlord Studio? Check out alternatives and read real reviews from real users.

Free Accounting Software For Landlords

- a record of your rental income and expenses, and

- supporting documents for your income and expenses.

You need records of your income an expenses to figure out whether your rental activity earned a taxable profit or incurred a deductible loss during the year. You'll also have to summarize your rental income and expenses for each rental property in your tax return (IRS Schedule E).

You need receipts and other supporting documents, such as credit card records and cancelled checks, to serve as insurance in case you're audited by the IRS. Such supporting documents enable you to prove to the IRS that your claimed expenses are genuine. Some expenses--travel and entertainment, for example--require particularly stringent documentation. Without this paper trail, you'll lose valuable deductions in the event of an audit. Remember, if you're audited, it's up to you to prove that your deductions are legitimate.

If you own more than one rental property, you must separately keep track of your income and expenses for each property—don’t mix them together. One reason for this inconvenient rule is that the IRS requires that you separately list your income and expenses for each property on your Schedule E. Also, you’ll never know how much money you’re making or losing on each property unless you separately track your income and expenses. Free graphic programs for mac.

Paper vs. Electronic Records

The first choice you need to make is whether to keep paper records you create by hand or to use computerized electronic record keeping. Either method is acceptable to the IRS.

Although it may seem old-fashioned, many small landlords owners keep their records by hand on paper, especially when they are first starting out. You can use a columnar pad, notebook paper, or blank ledger books. There are also 'one-write systems' that allow you to write checks and keep track of expenses simultaneously. Go to your local stationery or office supply store and you'll find what you need.

Free Landlord Software

Manual bookkeeping may take a bit more time than using a computer, but has the advantage of simplicity. You’ll always be better off using handwritten ledger sheets, which are easy to create and understand and simple to keep up to date, instead of a complicated computer program that you don’t understand or use properly.

If you want to use electronic record keeping, there are many options to choose from. These range from simple checkbook programs to sophisticated property management software. We won’t discuss how to use these programs in detail. You’ll need to read the manual and/or tutorial that comes with the program you choose. However, if you’re not prepared to invest the time to use a computer program correctly, don’t use it!

Create Your Own Spreadsheet

You can create your own spreadsheet with a program such as Excel to keep track of your expenses (such as insurance) and income (from rent and other sources). Use one spreadsheet per rental and then total them all at the end of the year.

Personal Finance Software

A personal finance program such as Quicken or Microsoft Money may be perfectly adequate for a landlord with just a few units. Such programs are easy to use because they work off of a computerized checkbook. When you buy something for your rental, you write a check using the program. It automatically inputs the data into a computerized check register, and you print out the check using your computer (payments can also be made online). You’ll have to input credit card and cash payments separately.

You create a list of expense categories just like you do when you create a ledger sheet or spreadsheet. Programs like Quicken come with preselected categories, but these are not adequate for landlords, so you’ll probably have to create your own. The expense category is automatically noted in your register when you write a check.

The program can then take this information and automatically create income and expense reports—that is, it will show you the amounts you’ve spent or earned for each category. This serves the same purpose as the expense journal. It can also create profit and loss statements.

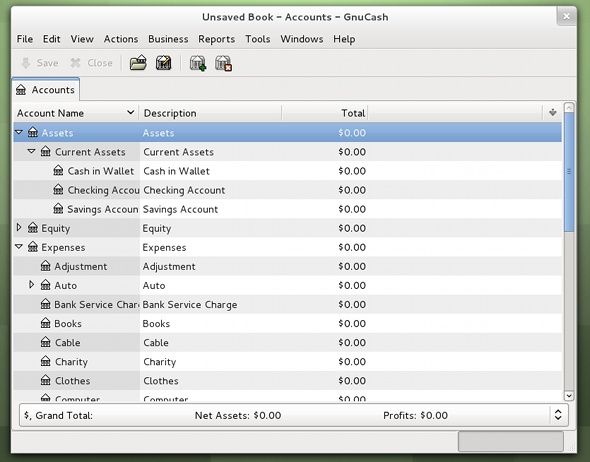

Small Business Accounting Software

Small business accounting programs such as QuickBooks by Intuit, AccountEdge and FirstEdge, and Peachtree AccountingAzure remote app for mac. by Peachtree Software can do everything personal financial software can do and much more, including: pay bills, reconcile bank accounts, generate sophisticated reports, create budgets, track employee time and calculate payroll withholding, and generate and maintain fixed asset records.

These programs are more expensive than personal finance software and are harder to learn to use. If you don't need their advanced features, there is no reason to use them.

Property Management Software

There are also many software applications designed specifically for rental property management including Quicken Rental Property Manager and Buildium. These can be particularly helpful if you own over more than 10 units. These applications have features designed specifically with landlords in mind. If you're interested, you should visit the websites for these applications, try a demo, and see if you need their advanced features.

Special Concerns When You Hire Employees

If you have employees—such as a resident manager—you must create and keep a number of records, including payroll tax records, withholding records, and employment tax returns. And you must keep these records for four years. For detailed information, see IRS Circular E, Employer’s Tax Guide. You can get a free copy by calling the IRS at 800-TAX-FORM, by calling or visiting your local IRS office, or by downloading it from the IRS website. Also, contact your state tax agency for your state’s requirements. A list of all 50 state tax agency websites can be found at TaxSites.com.